The largest recent development in PV module manufacturing that?s been around for over a year now is the move towards larger wafer dimensions and larger module formats that incorporate those wafers. They offer an impressive increase in power and a promise of higher energy yields and lower project costs.

There are questions about the optimal strategy and real possibilities, as well as ever-present risks that come with working with larger modules.

JinKo Solar has decided to use the 182mm wafer in their Tiger Pro modules. The 182mm wafer, also called M10, is said to represent an ideal balance of bringing new technology promising significant gains on energy yield, whilst also minimizing the risk that is inherent to any new technology in the way it interacts with other system components and the installation environment.

Embracing Ultra-High Power Large Module

The end market of the PV industry is continuously trying to achieve lower BOS costs and LCOE. This has given a boost to a growing trend to adopt high-power modules and to the improvement in module technologies.

Size Trend

Due to Vietnam?s installation rush and China?s utility-scale and residential project installation boom, the PV market in 2020 surpassed the forecast. The module demand in 2021 is predicted to reach around 154GW, growing 10% YoY. The main reasons for this predicted growth are projects that had to be postponed until 2021 due to the pandemic or an increase in prices in the supply chain. China, Europe, the USA, and India are forecasted to take up over 70% of the market share. China itself will occupy over 30% of the market share, while the Middle East and Latin America, driven by unsubsidized and utility-scale projects, are the rising stars of 2021.

The PV market has been shifting to the next generation wafer size sooner than expected. Half-way through 2020, the market began to shift towards M6 products. Nonetheless, most manufacturers already accommodate new production lines due to be installed with bigger-size wafers (182mm and 210mm). The PV market demand for M10 and G12 modules has increased dramatically in 2021 and will continue to grow. M6 wafer size market share is, therefore, predicted to experience a drop from 38% to 25% in 2022.

In the second half of 2020, Tier-1 companies began advocating for modules rated beyond 500W to optimize costs and LCOE. Some push for the 182mm modules (G10), while others promote the 210mm modules (M12). However, taking into consideration that the large-size wafer development is still at its early stage, G12 modules are facing various challenges, such as market acceptance, logistics, application of BOM materials, and yield rates. For this reason, M10 is predicted to dominate the market in 2022 and 2023, pushing the mainstream module power output to 500-550W.

PV Supply Chain Analysis

As for the wafer size, it is fairly easy to upgrade the size of the ingot growth furnace. Therefore, the development of large-size wafers is not a problem when it comes to production capacity.

Older cell and module production lines (such as M2 and G1) in China will gradually be removed after executing the existing orders.

Tier 1 manufacturers mostly choose to install new lines that are compatible with M10 and G12. Tier 2 manufacturers opt for modifying the existing lines.

Capacity for large format cells and modules comes from new production lines, given the advantages in cost and capacity they offer.

Due to production capacity and market demand, most manufacturers that install new cell and module lines compatible with sizes up to 210mm will be producing M10 modules in 2021. M10 will gradually become mainstream and will dominate the market from 2022 and 2023.

As a result, capacity for large-size modules will grow robustly from 50-80GW at the end of 2020 to 200GW+ by the end of 2021. The rapid capacity expansion has also accelerated the progress in the market share of large-size modules. Hence, there is no bottleneck for the development of large-size cells and modules.

The market share of bifacial modules experiences a rapid increase in 2020. However, the shortage of PV glass in the second half of the year caused an increase in bifacial module production costs and prices. For this reason, PV glass production capacity is of interest to both buyers and sellers.

In 2021, capacity will face a bottleneck in the polysilicon and large format glass segment. It will not, however, affect the development of the bifacial modules. Many Tier 1 module manufacturers are speeding up the assessment and certification of bifacials with transparent backsheets. The production of those is predicted to continue growing from 2021 onward.

Module Prices Trends

As the production of M10 and G12 modules continues to increase, and since such modules are mainly intended for use in ground-mounted systems, the price gap between them and M6 modules is gradually narrowing.

Prices of M10 and G12 modules are predicted to come in at 1.63-1.68 RMB/W or 0.223-0.23 USD/W in the first quarter of 2021, depending on the size and delivery deadline of each project.

There are currently fewer makers of G12 modules. Many 182mm module producers have also expanded their cell capacity, while a great number of 210mm module makers are still buying cells from Tier 1 cell makers, causing an increase in the module production cost. There is, therefore, a slight price gap between M10 and G12 modules.

Maturity of 182mm Modules

Availability

The global market demand for next year will be between 140 and 160GW. The expected capacity of the top three major suppliers is 90.2GW in 182mm cells and 108GW in 182mm modules. This is going to drive all the other manufacturers. That, in turn, will play a great role in the availability and prices of the modules.

Reliability

The safety margin of the junction box is 25% for the 182mm bifacial module and less than 0.2% for the 210mm bifacial module. As a result, the 210mm module manufacturers may opt for a higher fuse, which will result in additional costs and availability issues.

| Module type | Isc | Bifacial factor | Diode factor | Theoretical diode current requirement | Diode rating | Safety margin |

| 182 bifacial | 13.8 | 1.3 | 1.25 | 22.4 | 30 | 25% |

| 210 bifacial | 18.43 | 1.3 | 1.25 | 29.94 | 30 | 0.18% |

Due to higher current, there will also be additional losses in the cable and issues with hotspots. The industry needs time to adjust to the big leap in the electrical current in G12.

It has also been proven that 182mm size doesn?t cause any additional problems related to micro-cracks, mechanical load, and so on.

Wafer producers are constantly trying to decrease the thickness of the wafers. A thinner wafer means lower cost. However, caution is needed, and reliability needs to be guaranteed as the installed modules are expected to work for 30 to 40 years. Quality cannot be sacrificed in order to reduce costs.

Compatibility

Capability – Inverters

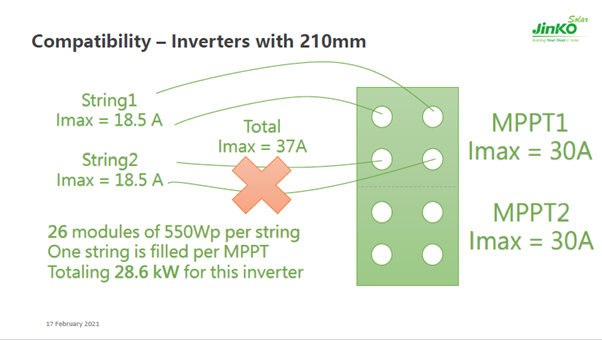

Due to the maximum current capacity of the inverters (lmax = 30A per MPPT), only one string per MPPT can be used in 210mm. With 26 modules of 550Wp per string and one string filled per MPPT, a total of 28.6kW per inverter can be achieved.

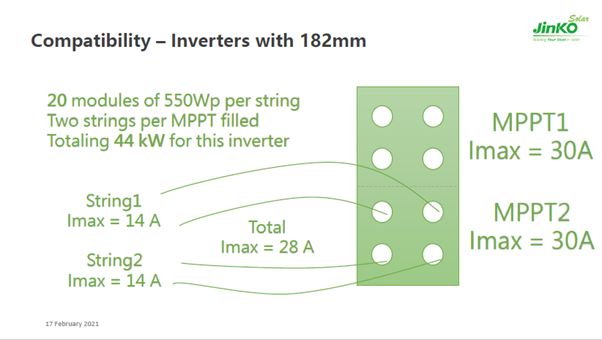

With 14 A per current in 182mm, it is possible to add two strings per MPPT. As a result, only 20 modules of 550Wp per string can be used. However, with two strings per MPPT filled, a total of 44kW per inverter can be achieved.

Capability – Tracker Mounting System

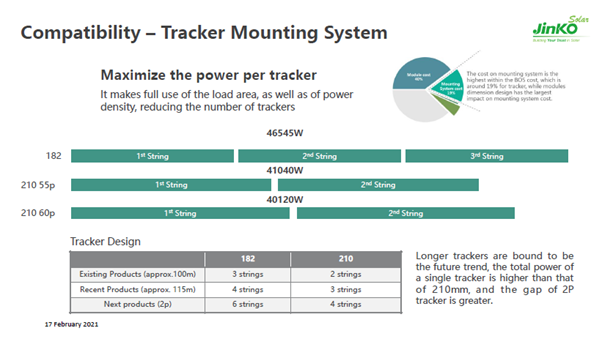

Considering existing products (approx. 100m), using M10 makes it possible to put three stings per tracker, compared to two strings using G12. Since longer trackers are bound to be the future trend, that gap will become even greater in the future. M10 modules make full use of the load area and power density, reducing the number of trackers.

Cost

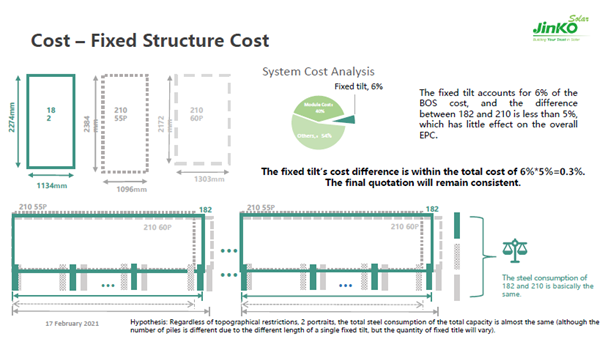

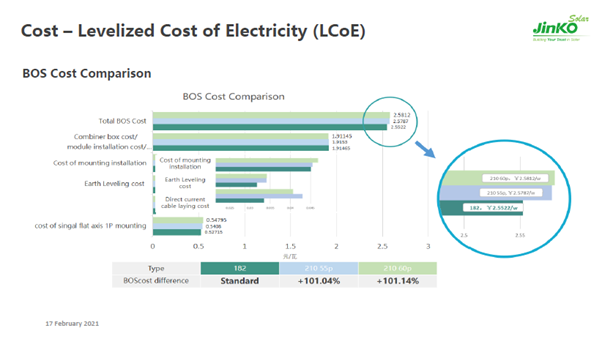

The steel consumption of 182 and 210 is basically the same. The fixed-tilt accounts for 6% of the BOS cost, and the difference between 182 and 210 are less than 5%, which has little effect on the overall EPC.

Choosing the 182 72C module results in increased power capacity per container, reducing the cost of logistics and transportation.

| Module | Number of Modules (pcs) | Capacity (KW) |

| 166 72C | 620 | 285 |

| 182 72C | 620 | 335 |

| 210 55C | 558 | 307 |

| 210 60C | 448 | 268 |

The total BOS cost is the lowest for M10 modules.

Conclusion

In the next two years, the M10 modules will be dominant in the market. The future depends on the analysis of whether there really is an added value in increasing the cell size. For the time being, the 182mm is the most reasonable choice from the financial and technical point of view. It has the most positive impact on the system in terms of quality, generation, yield, and LCoE.