If you think bifacial modules are a recent development in PV technology, you couldn?t be more wrong. Bifacial modules have been with us since as far back as the 1960s. However, they had not been a big player in the market for decades. It?s the development of PERC (Passivated Emitter Rear Cell) technology that has proved to be a gamechanger. It has greatly increased the efficiency of bifacial modules, thus making it a competitive option in the PV market.

Do bifacial modules have the potential to become a major player in the solar panel industry? What factors need to be considered?

Cost

In recent years, the costs of both mono- and bifacial modules have decreased tremendously. Together with that drop, though, the gap between bi-and monofacial modules has become significantly smaller.

Bifacial module market share is expected to continue increasing. There are, however, many other factors that are still preventing the widespread popularization of bifacial modules.

While the increased equipment and installation costs of bifacial solar plants are not excessive, there are many design elements that are unique to the bifacial system and add to higher total installation costs.

The DC design, location of the site, and installation are more challenging for plants using bifacial modules as compared with monofacial modules. This may make investors a little more apprehensive.

Due to multiple variables that influence rear side production, it is also a challenge to accurately predict the increased output for a system design.

Accurate Measurements

With all the variables that need to be taken into account, it is not easy to accurately measure the cost of a bifacial plant and predict the power production.

It?s no brainer, though, that bifacial modules increase power production. It has been proven that bifacial panels can produce between 10-20% more power than monofacial modules. And with optimized conditions and single-axis trackers adopted, the power production increase can reach even 30-40%.

Keep in mind, too, that we are always searching for LCoE (Levelized Cost of Electricity). There are other options to boost power production even higher. For example, dual-axis tracking can make power production climb. Methods like that, however, are not cost-effective, which makes them impractical.

The main challenge that bifacial modules need to overcome is not being able to create accurate simulations. Only when financial queries concerning additional costs are satisfied will it be possible for bifacial modules to become a disruptive player on the PV market.

So what has been done so far?

There have been improvements in testing and modeling, as well as in irradiance and geospatial data availability.

Many bifacial test sites have been constructed, studies have been undertaken, and bifacial installations have been completed providing real data. All the challenges haven?t stopped bifacial installations from growing. Installed global capacity had grown sharply from 97 MW in 2016 to nearly 6 GW in 2019. This increase is expected to continue, and bifacial modules are predicted to be responsible for 17% of the global solar panel market in 2024.

Bifacial Installation Optimization

The data we have gathered from tests and completed installations enables us to provide certain recommendations that will allow for bifacial installation optimization as well as increased ROI and lover LCoE.

Site Selection

The cost of land is a significant factor in choosing what kind of modules should be used. In places where finding suitable land is difficult, and the prices are high, panels should cover as much of the area as possible. On the other hand, in places where land is cheap and available, bifacial modules can be installed with optimal spacing for increased yield. Lands at higher latitudes are also more suitable for bifacial modules, as bifacial yields are bigger in places where the diffuse light energy is greater.

High Albedo

The best environment for bifacial modules is one with a high proportion of light that is reflected by the surface. Desert sand, snow, ice, white concrete, and highly reflective roof foil all have a very high albedo.

Panel Hight

Increased panel height makes it necessary for other variables (such as wind speed and lift from the tilt) to be measured and taken into account. Stronger ground mounts may be required. The optimum height will therefore be different for each site. Generally speaking, though, 1 meter has shown to provide good benefit to cost ratios.

Tilt

Again, this is not set in stone, but somewhere between 2-15 degrees more than the monofacial tilt has proved to be most effective.

Row Distance

The precise distance between rows will be affected by the above-mentioned land price and availability. However, 6 to 8 meters seems to be most efficient. In places where land prices are very high, a bigger row distance would cause an increase in the LCoE.

Greater MPPT Density

The more MPPTs per watt, the better. One way to reduce string mismatch and ensure site efficiency is to use string inverters with more MPPTs.

Single-Axis Tracker

While it is true that dual-axis trackers achieve the highest energy generation, their costs are very high, making their installation not cost-effective. Therefore, as concluded by researchers from the Solar Energy Research Institute of Singapore, bifacial installations with single-axis tracking reach the lowest LCoE and provide a 35% increase in energy yield on most of the land across the globe.

Bifacial vs Monofacial

The cost of equipment and installation of a bifacial solar plant is approximately 5% higher than that of a monofacial plant. The cost of adding a single-axis tracking system for optimal yields increases the cost by a further 10%. In total, the cost of a bifacial, single-axis tracking solar power plant is around 15% higher than that of a monofacial non-tracking plant.

However, the energy yields from a bifacial 1T solar power plant can be between 20% and 35% (or even more) higher.

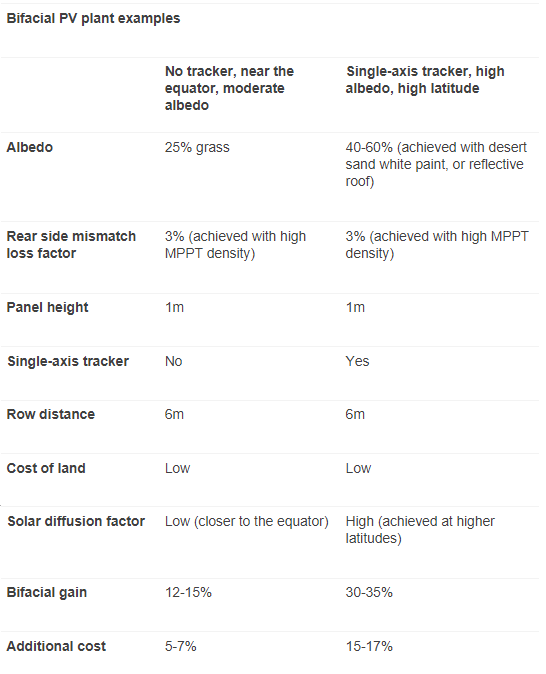

The table below shows two examples of bifacial PV plants together with the variables.

Financing

Investors are often unwilling to finance the full amount of the predicted rear side energy production. This is due to the relatively small amount of reliable performance data and uncertainty in the modeling and simulation stage of bifacial plants.

Imagine a bifacial project that is expected to provide 10% more yield than a comparable monofacial project. The lender may not value the full predicted bifacial gain and offer only 5% (instead of 10%) more debt financing over the monofacial project. This will result in added financing costs and increased LCoE.

What Does the Future Hold for Bifacial and Large-Format Modules?

It is true that the industry is still struggling to manage the variables of predicting the output of bifacial modules and to manage the costs of power optimization.

However, as these challenges are being slowly but steadily overcome, it is clear to see that the PV market is shifting towards large-format cells and modules. The market share of bifacial modules has been on the rise. And since increasing the module size brings instant returns, it is safe to expect that the solar energy industry will continue to make the development of large formats and bifacial products a priority.

It is not a difficult job to modify production lines to manufacture bifacial cells. Tier-1 cell manufacturers? production lines for M6 cells are mostly compatible with bifacial cells. And when it comes to efficiency, some bifacial cells can even provide 0.1% higher efficiency, which decreases the cost per watt. Moreover, starting in the second half of 2019, the price gap between mono- and bifacial modules has become more and more insignificant. On top of all that, bifacial modules have a higher energy yield potential.

Bifacial modules seem to be an ideal solution for optimizing power generation in highly reflective regions like deserts. And bifacial cells in a single-side module with a reflective backsheet can bring the power output up by 1 W to 2 W.

There has been a significant increase in bifacial solar modules being used in utility-scale projects in both the Chinese and non-Chinese markets. In the second half of 2019, around 30% of all utility-scale projects in China used bifacial modules. And between January and May 2020, China exported over 3 GW of bifacial modules (25% of which were exported to the USA).

No wonder, then, that Tier-1 cell and module manufacturers have been promoting bifacial modules that are on the road to becoming a PV industry standard. Both the demand for bifacial modules and the market share have grown sharply.

Evolution of Sizes

The G1 wafers (158.75mm) were adopted by the market in the second half of 2019. However, they were only able to maintain their dominance for about a year.

Searching for cost reductions, water manufacturers sped up the shift to larger sizes. As a result, the M6 (166mm) size became mainstream in the second half of 2020. At the same time, an alliance of module companies started promoting the M10 (182 mm) size. With this variety of sizes and rapidly changing trends, compatibility has become one of the biggest concerns for manufacturers and their expansion plans.

Upgrading existing production lines is expensive and adjusting efficiency losses and yield rates are time-consuming. For this reason, most manufacturers choose to install new lines that provide compatibility with sizes up to 210mm. This will allow them to avoid extra CAPEX when the size trend shifts again. They will also continue to promote large-size cells/modules because installing and using equipment that is compatible with large formats to produce smaller-size products may result in a loss in both production and profit.

Demand Predictions

Supplies of glass are predicted to remain tight. Prices of 3.2mm glass had gone up very sharply by 20% between September and October 2020. Additionally, since glass-glass is the most popular structure of bifacial modules, the ever-increasing demand for bifacial modules is contributing to glass capacity shortage.

As the Covid-19 pandemic impact seems to abate in 2021, the solar demand outlook becomes brighter. Global module demand is estimated to reach 140.1 GW in 2021 due to the projects put off because of the pandemic in 2020 and the expected June 30 installation rush in China.

Glass capacity for large modules based on M10 and G12 wafers is predicted to reach only 40-50 GW by the end of 2021. That?s a result of the limitation of furnace sizes and the time needed for capacity expansion. This means that the glass supplies remain far behind the rapid module size shift.

Despite increasing demand, the actual production of large format modules will not grow proportionally fast due to insufficient glass capacity. This means that the M6 will maintain its position at the mainstream format for now, and M10 and G12 formats are expected to become and remain mainstream in the next couple of years.

It is true that 217mm, 220mm, and even 230mm formats are already being considered. However, there are many issues that need to be dealt with first. There are technical issues, such as breakage rates, texturing, and coating, as well as acceptance of such products by both the manufacturers and customers. More research and many improvements need to be done before sizes greater than G12 could even try to be introduced into the market, if at all possible.